| Author | Message | ||

Torquehd |

Like far too many, I should have started investing earlier. I'm 35 so I've got a ways to go but I wish someone had set me down when I was 20 and said, "look, someday you'll be 65 and unable or unwilling to work", and then showed me the math on how a half million dollars isn't much from age 65 to 95, and further showed me the numbers on how compounding interest and return rates work. I'm active Army, been paying into the TSP for a few years, but far too little and not in an aggressive fund. I'm in the process of fixing that, and I'm depending on the TSP being the mainstay of my retirement. I've got 9 years left that I can contribute. I'm also wanting to take a chunk of change (10k) and drop it into a fund outside of the TSP as well, and then throw it a couple hundred dollars every month. I'm not smart on this stuff but ETF's seem to be all the rage. My financial advisor at Navy Federal advised me against ETF's, to go with a more diversified mutual fund instead. Is he just trying to sell me something? Anybody smart on this stuff? How aggressive should I be with my TSP since I still have 30 years before I plan to start making withdrawals? While I'm no spring chicken I know I'm a young pup compared to some of the more experienced folk here. What advice could you give, or what would you have done differently? Anything you would have avoided? | ||

Ratbuell |

Be as aggressive as you can afford to be, and still pay your bills. If you don't need to spend it...bank it. Somewhere. 401, savings account, safe in the basement...whatever works for you. Me, I like keeping cash on hand "just in case" in addition to bank accounts. I started late as well. I prefer (as a control freak) to have investments that *I* control, so in addition to a relatively small (but gaining thanks to our current economy) 401k, I have rental properties. I'm good with my hands so I do my own renovations and maintenance, and get the properties fixed up NOW (roof, electrical, heat pumps, kitchens, bathrooms, etc), so in my autumn years all I have to do is the occasional maintenance/repair (not full-on system replacements)...and collect a rent check. I don't cheap out on materials - real tile instead of laminate, hardwood floors instead of carpeting, LED lighting instead of old incandescent fixtures - all stuff that's harder for careless tenants to damage. If you screw up a hardwood floor...you TRIED. Carpet...plan on replacing at every tenant change, if not more often. Built it right, build it once. If you decide to go this route...get properties close to your home. Like...in your neighborhood. Travel time to fix stuff is a bitch - not only is there time involved where "it's still dripping and I'm sitting in traffic", but once you get there (however far from home) and realize you brought the wrong wrench and now you have to either go back home, or go to Home Depot and buy your fifteenth half-inch pipe wrench...it's a pain. But all that depends on your personal tastes - I like fixing stuff, and being able to say "I did that". Some people don't. Some people can't. Some people are fine with allowing banks and fund managers control their future - I'm *marginally* OK with that, hence the 401k, but I still like keeping as much cash on hand as I can (and a tenant who pays cash every month makes that very easy to do). Some folks swear by precious metals - gold and silver. I haven't had the opportunity to buy enough to make it "investment-grade", but I need to start tracking weight-values to see if it is really worthwhile to have laying around, as a more universal "just in case" investment than US currency. And...this is a good market right now. Talk to your manager and have them up the "aggressive" scale a bit on your TSP. I need to do that with my 401, actually...I'm fairly conservative at the moment and still doing well, so I should call and have them up the ante a bit to get some bigger returns while the market is doing well. | ||

Torquehd |

I'm also interested in rental/real estate, but from everything I've heard, it takes a good chunk of cash up front to get the ball rolling. IE, if you're going to buy a house to rent it out, you need to already have ~20% equity in it. Taking on another mortgage at full-rate with no down payment, and then trying to rent the house and hope i make money, seems far-fetched. I actually own a house that I'm renting out, but I used my VA loan with nothing down, and I'm making virtually no money on it. My tenants are paying down my mortgage, but I'm also renting a house for a similar rate so I'm not coming out ahead at all. Rentals and/or real estate is an idea for a retirement business after I get out of the Army. I'll be 44 then so I'll still have plenty of time (I hope) to keep working. And investing in the future. Hopefully I'll have it figured out, and some cash to spare, by then. Plus I love the area I call home so it'd be great to have a few houses spread out across the area. | ||

Sifo |

Anything you would have avoided? REITs! How aggressive should I be with my TSP since I still have 30 years before I plan to start making withdrawals? I would say as aggressive as you can sleep at night with. I'm about to turn 59, and will probably hang up the working life for good before 60. Still quite aggressive in my investing. Bottom line, even when retired, most of my money will not be touched for a very long time, so it's still long term investing. Some money does have to be allocated as mid term and short term though. I hope your adviser has talked to you about your risk tolerance. I've known people who have invested modest amounts in mutual funds, and checked values daily and couldn't sleep. You don't get reward without some level of risk though. It's about your risk tolerance though, not mine. I'm not that familiar with ETFs, but as I understand them, they are a type of sector fund. That gives some diversity, but whole sectors do have their bad times. My choice has pretty much been mutual funds, of which some can have similar issues. Many offer much better diversity though. MFs also tend to have more active management, along with higher management fees. Nothing wrong with paying slightly more for better results IMO. And yes, you can burn through half a million dollars surprisingly quickly. Especially if health issues creep up in later years. And who knows what the state of our insurance system will be in a decade. Sounds like you are asking the right questions. That's a big part of getting on track. One thing we did that was fairly unconventional, was to pay off all loans, including mortgage ASAP. Conventional wisdom is that you can get better returns than what you pay in a mortgage, and you get tax deductions (mostly up front in the mortgage). It did provide us with the comfort of knowing that we didn't have to scrape together monthly mortgage payments when things get rough, and they did at times. | ||

Ourdee |

10 years early and aggressive is hard to catch. | ||

Greg_e |

Are you putting in the maximum allowed on your TSP? That's $18,000 (or more) per year for federal employees. You can log into your TSP account and check how much you are allowed to put in each year. I would look for work in the federal government after you get out, I can get specific details if you want, but they might be specific to the VA Hospital system. Lots of rules about buying back retirement credits and stuff like that. New York State retirement also let's you buy back credits toward the State retirement system. | ||

Torquehd |

I figured sooner or later I'd hear from someone else familiar with TSP. The max I believe is 19k but that's out of my financial ability right now. I just upped it to 11% of my base pay but I anticipate nearly doubling that within the next few months. The TSP really seems like a good deal, I wish I could continue to contribute after I retire from the Army. | ||

Aesquire |

As you are active service you can join the Thrift Savings Plan, TSP. There is probably a matching contribution from Uncle up to a certain percent, ( 5% of your pretax pay is matched by the Post Office, but your plan is different ) and you can put in up to a higher percentage max. ( mine was 15% yours? Ask! ) Every penny matched is free money. ( not exactly, but closer than anything Bernie promises. ) And if at all possible, max your contribution out, but at least to the max that's matched or you lose the free money, and it's literally doubling your money later. Also less taxes means the bite isn't as bad as any post tax deal. It's basically like a 401k, in that the money comes from your pretax pay, and the remainder is taxed less because of that. You then pay tax on withdrawals after retirement, which is assumed to be less than before you retire. Index funds are bundles of stocks that invest in a number of companies In various ways. They match the general ups and downs of the market. ( which is a better deal than almost all "manager funds" where someone else chooses which stocks to buy. The really good guys make more than the market, but most don't do as well.) https://www.tsp.gov/index.html https://www.tsp.gov/InvestmentFunds/FundsOverview/ comparisonMatrix.html Imho you're stupid if you don't at least contribute to the matching percentage amount. And it's effortless. Invisible. And if you don't panic when the news is weird, you're fine. That's just from work, you can also buy post tax funds, and not pay taxes on them when you retire. https://www.thesimpledollar.com/what-does-pre-tax- and-post-tax-mean-and-why-should-i-care/ Also traditionally, real estate keeps it value well, but the "flip this house" myth pushed by mostly con men isn't a good idea. Not that buying property and busting your butt to improve it with sweat isn't a good idea, it's the get rich quick stuff that's a bad idea. The above is an oversimplification. The smartest thing to do is ask how much some product costs you. Some dealers that sell funds take a percentage of your money, every year, to invest your money. Others charge up front, and there's a lot you can do just yourself buying & selling stocks, bonds, & funds ( which are collections of investment items packaged for you ) But solo, you are in a big Casino and better know the rules & odds, or you get taken. Star wars bobble head dolls are another investment idea, but probably a stupid one.  The important thing to remember is investing is gambling. There's a house cut. In the case of the Federal TSP, that cut is part of the pay you get, and everyone gets a couple bucks less pay than it they didn't have the TSP. So you pay the house cut it you use it or not. Private brokers take a cut in various ways, a percentage, ( bad ) or an up front fee ( better ) and then the funds themselves take a cut in various ways. Everyone makes a buck. You want to pay as little as you can. Talk to a pro. More than one. The other important thing, & I can't stress this enough, is stuff like the TSP is imaginary,or virtual money until they send you a check. In my own example, I'm in several options but mostly the S&P 500 Index, so when I got my statements during the Bush regime I had $x dollars, then 3 years later it was less, even though I kept on putting it in, and now it's more. So remember when the markets act up and you think you lost money... You haven't, unless you cash out when the markets suck. Ditto when the markets are booming, you didn't make a small fortune, unless you cash some out. ( and if you're smart, invest it in a different way ) So basically, I'm an idiot unless I cash out some small part of my TSP ( 401k ) right now, and take some winnings. Or I'm gambling it will get higher, later. ( not a bad bet, it's almost a sure thing over decades, from year to year? Not so much. ) I hope this helps, and I'm CERTAIN others will correct my errors. (Message edited by Aesquire on July 25, 2019) | ||

Greg_e |

If you work for the federal government after you get out, you will still be able to contribute to TSP. Get a job at the nearest VA hospital, vets have preference for jobs there. Or consider being in the reserves in order to flesh out the retirement. My lady works in HR at the VA here, so I hear about a lot of this stuff. And I work at a state retirement job, lots of guys bought years back to get to the end of the state system, not sure how this would affect TSP, but probably not at all. | ||

Macbuell |

Open a Roth IRA. They are post taxes so you will only get taxed on the gains when you take out any money. Also, since they are post tax, you can take the principal out at any time without penalty. Lastly, almost all mutual fund companies offer funds tied to a retirement date that will adjust their risk profile the closer it gets to that date. You could invest in one of those. If you want to do it yourself, chose 3 mutual funds with good ratings, low costs and the right risk profiles. Small Cap, high growth equity funds will have the highest return but highest risk profiles. | ||

Pwnzor |

My 401 is in the most aggressive package offered by my company's financial services provider and it has consistently returned above 10% and peaks around 16.75% Beyond that I've got a bunch of money in a metal box somewhere. | ||

Torquehd |

...has consistently returned above 10% and peaks around 16.75% Wow. In my number crunching, I use 5% for the return rate. I'm not even going to look at 10%, I'll get my hopes up. Does your employer match your contribution, and if so is that considered part of the return rate? One of my early frustrations was trying to figure out what kind of return rate I could use for number-crunching. No one wants to say a number because of the obvious difference in outcomes due to market, strategy, etc. I finally settled on 5%, I hope that is a moderately safe rate. Not to bank on, but to ballpark on. My financial adviser put together a pdf with all kinds of data, most of which I don't understand yet, with a tentative mutual fund game plan. From everything I'm reading online it sounds like the performance of a mutual fund is going to net a little less than playing stocks but be somewhat more secure, and easier to simply throw money at it each month. He's going to go through it all with me next week. I'm still interested in ETF's but he made it sound like it's harder to contribute 1 or 2 hundred dollars each month. | ||

Aesquire |

My reply took so long to write everyone else already did it better! It didn't help I was so long winded I edited it down to the infantile mess seen above.  Btw,you can keep putting money in the TSP after leaving Federal service. The radio investment guys say be full aggressive at your age & start tuning your portfolio when you get to be 50 or so. Gold, is a stupid investment today IMHO. For 2 reasons. The big growth is already over & it's overpriced now. The market in Gold is subject to manipulation by the big owners. George Soros ( Hail Hydra! ) dumped 14 tons and crashed the market single handed. ( & made another huge fortune doing so ) China & Russia both have been buying lots of gold so they can also use it as a weapon in a trade war. Or maybe I'm wrong, but when they start buying radio ads to sell something like gold, that means it's High priced and the folk that own it want to cash in. Otoh, they sell mutual funds in the radio so they can make money like any other products for sale. Cautious in this case isn't paranoid, it's good sense. If it sounds too good to be true, it probably is. By all means he "aggressive" in your choices in your TSP, just don't buy any bridges, they're a scam. ( rumor says my uncle already bought the Brooklyn bridge, anyway) | ||

Torquehd |

from https://www.tsp.gov/LifeEvents/career/enteringReti rement.html "While in retirement from Government service, you can no longer make contributions to your TSP account," A job at the post office sounds like a plush post-Army job but I've heard it's hard to get on at the post office due to supply of willing would-be-workers vs demand of vacant seats. | ||

Sifo |

Getting set up with automatic contributions each month is critical to success IMO. Few will do it on their own if they have to write a check. 5-6% is probably a reasonable target return. It's been a while since we've really had a big market correction that knocks average returns down to that level. I've seen about 30% gain in a year before. Don't expect that often. I've also seen 15% losses for a year. Volatility can be tough to stomach for some. In reality, I've probably averaged about 9% returns, but I wouldn't bet my future on that continuing forever. I would much rather leave extra cash to family than find I'm broke-assed 80 year old. Investing in individual stocks is a PITA. Can you get time to talk with the CEO of a target company? Money market managers can and do. They know what to ask too. It's their job, and the good ones are good at it. It's one thing to pick a good stock to buy. How do you know when to sell? Every purchase should have stop-loss points in mind. Or, you may choose to double down if the stock goes down, and you still like it long term. Do you have a target price to sell at? Point is, it's a lot more complicated than investing in a MF. I played with it years ago, and found I didn't do as well, and it took much, much more effort. Also, don't invest in a company that you don't understand well. I played with tech stocks back when I was working in the computer industry. That won't give you and edge over the pros, but gives you a fighting chance. | ||

Tootal |

My friends have been retired for a looong time. The wife was a VP at Merrill Lynch. They are heavily invested in Large Cap Stocks. Even though this is considered risky by many she showed me that they've been living off the profits all these years and still have their original investment. Merrill Lynch controls most of it so I don't know what exactly their profile is but T Rowe Price has some great large cap options that are doing well and part of my 401K. Don't feel bad. In order to become old and wise you must survive being young and STUPID! I didn't bank anything in my 20's. I was having too good of a time but I did bank a lot of great memories! So a late start is not as good but it turned out ok for me. I finally cut back on cars, bikes and travel to invest and it all worked out. Thank you for your service! | ||

Court |

>>>>In my number crunching, I use 5% for the return rate. Continue to. Don't order a Unicorn and expect to get one. Work with that 5% and you'll be fine. Make the contribution automatic. I have contributed 50% of my pay (kids are long out of the house and long out of college) since moving to NYC. If I had to write a check . . . I'd be too broke to buy lunch today. I have a bad guitar and car problem. When you think your are "maxed out" . . . try bumping it 1% and see if you notice the "diminished income". You won't. When you can't recall the last time you bumped it 1% . . do it again. That's how I eventually got to 50%. And . . . Use your common sense . . . go back and read that "if it looks too good . . . " advise. Listen to the internet about 17 seconds a year and play the long game. I've just made a huge adjustment in my personal plan . . . after signing a 5 year contract the day I went in to tell them I was retiring. Look at YOUR situation . . . plan wisely . . . and celebrate that fact that you are doing something. Never compare yourself to others (a periodic listen to the Desiderata is sometimes in order) and you're welcome to use my "something is better than nothing" mantra . . . if you are saving ANYTHING . . . you are a league ahead of most the world. Just my $0.02 (USD - non-inflation adjusted) | ||

Court |

Oh . . and . . .NEVER, NEVER, NEVER try to use that "I started late" as an excuse. On the days I am actively wanting to make myself feel like crap . . . I go back and play "If I'd just saved $1 an hour since I started working . . . . . what would I do with the $23,000,000?". It's that Unicorn . . . recognize it, have your giggle and stick with YOUR plan. | ||

Pwnzor |

My secret is I just pile money into it and don't pay any attention to it. I firmly believe that we are in the end times and Jesus will walk among us in my own lifetime. Money is meaningless to me. On the other hand, if I live out my years and die naturally, something will hopefully be there to carry me and pay to burn up my remains. | ||

Greg_e |

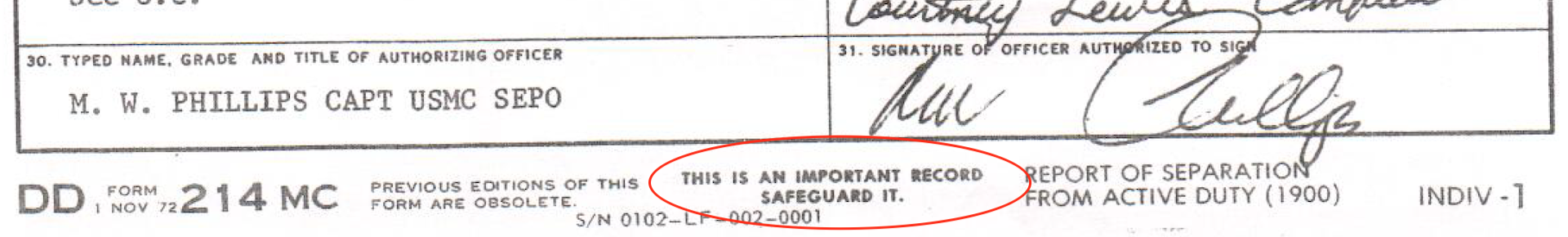

The key is to not retire, I don't think you are forced to "retire" just because you leave the service. I do know there is a big penalty if you start drawing on that retirement, and then get another job with the federal government. It's a ton of paperwork to get things handled. I'm sure it is the same if you go to work in a state retirement system. You'll need to check on all that, but pretty sure that you don't need to retire to separate from the service and keep all your benefits (or at least most). Also, if you have a secret clearance of any type, make sure that is in good standing when you separate. That alone can mean the difference between you and some other person getting a specific job. Many things at the VA hospital require some level of clearance because you are dealing with people's records. From scheduling appointments up to HR she has had a few different checks as she worked up the ladder. If you get into a decent place, the scheduling of appointments (MSA) isn't a horrible job, though it doesn't pay a huge amount (grade 5, 6, or 7 depending on functions and number of years). Several things in HR start at 4 and go up to more than 12 (she is on a track toward 12 right now, just got appointed to this position). These are normal GS scales, so you can look them up if interested. Oh, and protect your DD214 like it is made of gold, sometimes they can be hard to get replaced and the original is better than a replacement. Once you get out, you will probably have a good number of productive years left in you to continue working. | ||

Court |

>>>>Oh, and protect your DD214 like it is made of gold  | ||

Torquehd |

All of this future planning has revealed a major sticking point. My mom has no money, no retirement, and she's 58 working a low-income job, and renting a small apartment. She's got basically nothing to her name.... I forget who posted this quote, but whoever did was spot-on. "there are two types of people in the world. Those who don't do math, and those who support them". She's going to have to continue to work and my brother and I will have to help her out. I started researching social security and medicare... Why don't we get taught any of this stuff in school? This is really important but you never learn anything about it in public education. But that's the time to get exposed to it and HAVE to start thinking about it. It should be a mandatory high school class. Seems like the only way to get ahead is to start with a chunk of money and a parent or two to help you start making good choices when you enter the work force. Why is that so hard? My parents taught me absolutely nothing about any of this. They were horrible with finances. By the time my dad passed away (at the early age of 44), his mortgage was approximately double the original amount. I will not set my children up for failure. They will have a budget and the will invest from the beginning. If I have any influence what so ever. I love my parents to death but frankly they were horrible with money and raising children with no financial guidance or responsibility is a great disservice. Edit. I am not blaming my parents. I don't have to blame them, because (Lord willing and the creek don't rise) I can do math and make choices that will influence the outcome of my (and my family's) future. While I may be a de-facto "millennial" (did you know that a 35 year old is considered a millennial?), I do not blame others for my choices or decisions or outcomes. (Message edited by torquehd on July 27, 2019) | ||

Ratbuell |

Why don't we get taught any of this stuff in school? They used to, it was part of a Home Ec. system that also taught things like sewing, cooking, cleaning...but given the state of our overall "educational system" today, if it doesn't teach "tolerance", "equality", or "social justice"...it doesn't make it onto the curriculum. It isn't education - it's indoctrination. Teach your children, because the system won't. | ||

Slaughter |

I "started late" at age 45. No kids, just spent most of my disposable income on "fun" stuff. I now throw all I'm allowed into my 401K and then all I can afford into a few mutual funds. Forget precious metals. Forget Real Estate (unless it's your own). The main thing I had to do was KEEP MONEY OUT OF MY HANDS! | ||

Torquehd |

My little brother (33) just blew my mind. I had the finance talk with him about himself and mom. He's building a couple businesses which I knew about, but he plans to continue to draw pay from after he hangs up the tool belt, he went over some numbers off the top of his head with me. And he's planning on using HELOC or something like that to pay for mom's health bills, then use her life insurance (which she doesn't have yet but it's a work in progress) to get reimbursed. It sounds like he had all this stuff figured out 10 times better than I could have. | ||

Tpehak |

If you have no money then invest in you health. Do workout, eat healthy food, sleep 8 hours, do not drink, do not smoke. | ||

Ourdee |

They used to, it was part of a Home Ec. system that also taught things like sewing, cooking, cleaning... Used to be good classes in school; Ballroom Dancing. sleep 8 hours, Get up at 4:00. | ||

Skntpig |

Read the book IRA weath. Itís all about Rothís and how to make all your gains tax free because you paid tax on the income before you bought the IRA. |