| Author | Message | ||

Bhillberg |

Ok, so I am looking into buying a new house in the near future. I was wondering if any of you guys could give some advice on how much money to spend? I know there used to be a rule that was something like you should be able to comfortably afford a house 2.5 times your annual salary. I have went online and did several calculators and they are saying that I should spend 3 to 4 times my salary. I know when I was approved before for my other house that they would approve me for way more than I was comfortable with. I just want to know what I could comfortably afford. I don't want to be a slave to my mortage. If any of you are in the business I would have no problem PMing you my annual salary and see what we could come up with. | ||

Halffast |

Here is what I would do. 1- Don't let a realtor or banker tell you what you can afford. You are the best judge of how much you are comfortable spending. 2- Make a budget. Include car payment, food (groceries and dining out), utilities, vehicle insurance, clothes, savings, etc., also include an amount for unexpected expenses (car breaks down, washing machine dies, etc) 3- See how much you have left-over When you see what is left then you can determine how much monthly you can afford. Don't forget homeowners insurance, taxes, moving expenses and furniture/appliances. 4- I would tend to go with the 2.5 X annual income as a ballpark number but that may have to be adjusted depending on the local market. This should be a decent time to buy. | ||

Ourdee |

The ideal amount involves paying cash. Not an option? If you have at least 20% in cash you don't have to pay that bank insurance. You want the cheapest house in an upscale neighborhood. No shared driveway! Make sure the land drains well. I stayed under 2.5 x annual salary without overtime and put 20% cash down. My wife is happy I did now. When buying I do the sniff test, First stop is the basement, Do I smell dampness, If yes I leave. In todays economy you should be able to get a deal on a turnkey house. ie. nothing wrong with it. | ||

Court |

All good advise . . . . no one knows less about home finance than a realtor and a banker. Study. Go in smart. Be patient. 20% down. | ||

Bhillberg |

In all honesty the 20% down is not going to be an option. I wish it was. The only saving grace in this is that I can get the VA loan and not have to pay PMI. | ||

Ferris_von_bueller |

Yea, this whole 20% down banks are looking for these days is not going to work. I doubt 10% of the population would qualify unless they are moving up and have equity in their existing home. Homes in my area start at about 200k, on the low-end, for a townhouse. How many people have 40k lying around? We have been a credit society for so long it's going to take some time for people to become accustomed to saving. Furthermore, if credit is going to be tight and require more down then prices of homes will need to fall to be more in line with what middle America can afford. | ||

Bill0351 |

I have been kicking around the idea of buying a house too. I don't have any more insight than you have, but here is what I have been doing: Every month I've been keeping track of how much money I have in the bank after I pay all my bills, expenses, and entertainment. I haven't been cutting back on anything, but I have also been keeping away from impulse purchases. I figure about half of what's left over is the amount I can increase my housing expenses and not have to give up anything else I like doing. I'm always amazed at people who live paycheck-to-paycheck and then go and buy a house that costs way more than they're paying in rent. Then, they wonder why they find themselves buried in debt after a few years. There was a short article on Yahoo News today that gave some reasons that now isn't a great time to be buying a house, but I wasn't sure I bought into the argument. When and if I take the dive, I'm planning on going the VA route too. Good luck, Bill | ||

Pkforbes87 |

I'll be watching this thread with interest, as I'm in the process of buying my first home via a VA loan. | ||

Bhillberg |

So I guess the 2.5 theory still holds weight. Bill seems to have a good experiment going on. | ||

P_squared |

I've bought 3 houses in the past 10 yrs. via VA loans. Things you should keep in mind: 1) You're likely to pay a slightly higher APR than a true conventional loan. 2) If you're lender told you there is no PMI, be sure you get it in WRITING. It's been a few years since the last time through, but we've paid PMI until we had reduced the principal to 80% or less every time we've taken a VA finance. 3) Be reasonably sure you will NOT be leaving the home in less than 2 years. There ARE penalties for defaulting on a VA loan and/or attempting to sell the home before occupying for 2+ years. 4) The more you can save now for the down payment, even if it's not the recommended 20%, DO IT. The sooner you get under the 80% principle, the sooner you can stop the PMI payments. 5) Based on doing an HONEST budget, be realistic on what you can COMFORTABLY afford every month in a mortgage payment. You should always have ~25%+ 'extra' income every month that is leftover after paying all bills. That 'extra' money every month can be used in a tactical means to set aside for unforseen expenses (you WILL have them) as well as helping to pay down your principle faster. 6)If buying a 'used' house, I highly recommend looking at the "new home" insurance that covers all major appliances, etc. Rates were ~$300 per yr. last I looked with a $50 deductible. It will pay for itself the 1st time your A/C goes out. 7) Unless you, or someone who will be looking at the home with you, is a contractor, pay the $$$ for a full home inspection once you think you've found a keeper. The VA inspection is NOT a full inspection. It's more of an appraisal to make sure the loan isn't for more than the house is worth and/or has MAJOR defects. 8)Last but not least, make sure you have your VA certificate and your lender is on top of processing it. VA loans, at least mine, all took longer than a normal conventional loan to process. The above info is based on MY experiences and is given free of charge. Take it for what it's worth. Any complaints, I'll give you a full refund of what you paid for this information. Good luck. | ||

Teddagreek |

First time home buyers have a 7K tax credit available | ||

Ourdee |

Length of loan is also an important consideration. If at all possible look at the difference in what you pay long term for a 30 year verses a 15 or 10 year loan. My first house I took out a 70k 30 year loan paid an extra lump of 7k the first year and took 10 years off the loan. | ||

Larryjohn |

Don't forget too look at the millage rates (taxes) also. I looked at all of the millage rates for the cities and towns in my area and was amazed at the different rates. You do have other things to consider like schools and what not but some of the districts with the best schools had some of the lower taxes in my area. It meant about $200 a month difference in our house payment. | ||

Court |

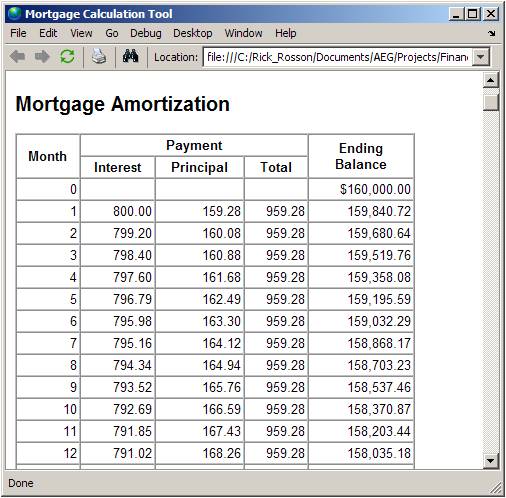

The tax credit is actually $8,000. >>>>In all honesty the 20% down is not going to be an option. Don't knock yourself out. It's more important ( I can explain if you'd like) that you understand the reason for at least being AWARE of the 20% target. In terms of loan length . . I'll share an old secret. When I bought my first house I went with a 30 year loan. I requested and they are always happy to give you, a LOAN AMORTIZATION SCHEDULE. It will look something like this.  Okay . . now follow me closely . . . The FIRST MONTH . . I paid the $959.28 payment ($800 interest + 159.28 principal). SECRET TRICK: But . . I enclosed a 2nd Check with "February Principal" in the memo section in the amount of $160.08. Then I crossed January AND February off the schedule. Since the February principal was paid in advance I NEVER owed the February interest. When February came . . . I wrote my mortgage check for $959.28 and, in the memo section put ($798.40 interest + $160.88 principle) AND enclosed (see a pattern) a 2nd check in the amount of $161.68 with a note (April Principal). Following me . . . . at the end of 15 years. . . the house was paid in full and I'd saved over $100,000 in interest. If you need more details let me know . . . your bank (the folks who make their living of that $100,000 of interest you are NOT going to be paying) make not be as free to share this information with you as I am. You're going to do great. Court | ||

Bhillberg |

Yeah, the 20% thing really isn't an option. In short I am in the middle of a divorce and living in my brother's basement so I can't really sit around and save up for a down payment. I can (for now) work a ton of overtime and that should help out though | ||

Bhillberg |

Court, I am trying to follow your formula for paying the principal a month early. Did you misspeak in there? I mean you said : "SECRET TRICK: But . . I enclosed a 2nd Check with "February Principal" in the memo section in the amount of $160.08. Then I crossed January AND February off the schedule. Since the February principal was paid in advance I NEVER owed the February interest. When February came . . . " So are you just getting a month ahead? or are you actually saving every other months interest? | ||

Madduck |

ONe thing to consider is the cost of housing/rental you are paying now. What you can afford in a house isn't going to be too far from what you are currently renting. When you find a house you are interested in, spend some time driving around the area after dark. Look for activity. A lot of areas become very undesirable after dark. Figure the extra deductions will cancel out your unexpected expenses. Never apply your income tax deduction to your affordability calculation. I wouldn't buy into any multi unit housing in this economy, likewise new developements. The big guys building spec homes are the next shoe to fall in this crisis. Check taxes and area restrictions from homw owner associations that cover your house. Enjoy the process, a lot of us like owning. | ||

Court |

>>>So are you just getting a month ahead? or are you actually saving every other months interest? Absolutely. . . . . and in doing so cut the term of the loan in half. I liked this much better than taking a 15 year mortgage. | ||

Court |

>>>>spend some time driving around the area after dark. Look for activity. A lot of areas become very undesirable after dark. Super advise. And . . before my checkbook came out . . I'd walk the area at 3 different times of day on a weekday and a weekend. Paul . . you and I are sounding like old men!  | ||

Sayitaintso |

>>>So are you just getting a month ahead? or are you actually saving every other months interest? Absolutely. . . . . and in doing so cut the term of the loan in half. I liked this much better than taking a 15 year mortgage. Great advice (and I'm a bean counter). It will save you a TON on money in the long run, and it gives you the flexibility to pay less in the event of some type of emergency. The only down side is that 30 yr mtgs have higher interest rates than 15 yr, but the safety margin you've built is well worth it. Another thing, you can look into is trying to get a HELOC at the same time you get the first mortgage. This way you have a smaller first mortgage and can get out of paying mortgage insurance b/c the first mortgage is below the threshold where they require you to have mtg. ins. | ||

Bhillberg |

A couple points I should make, First- I am looking at getting a house (NOT a new build) with at least 3 acres. Something in the country with some seclusion. The neighborhood advise is noted and can still be applied but maybe not as crucial in this case. I mean if I am secluded then that should kinda take care of it. The second is that this is not my first home purchase. I bought a house 5 years ago right before I got married. With the divorce pending I am trying to figure out what I can afford. I know I could make the mortgage on my old house but I don't know how much more I can take on safely alone. I don't know if I will be eligable for the 8k credit since I am not truly a first time home buyer. Like I said, I am currently living in my brothers (finished) basement and I can't stay here for a year saving up for the down payment. I mean I could, he wouldn't kick me out but I want to get my new life started. I will not rent though, I had to rent before and I hate the thought of actually just throwing that money away again. I guess if I stick to the 2.5 times my BASE yearly salary I should be good? | ||

Madduck |

When I bought my last house I bought the smallest house I could fit my stuff into, in a neighborhood that had residents about my own age and had a large three car garage. Get plenty of garage for toys, houses really aren't that important. For an isolated house look for sight lines from the highway or neighbors such that looters can be spotted when you aren't home. Clear field of fire is desirable also. Woke up at three am in my block to about 6 squad cars rounding up illegal aliens from the low income housing two blocks away. Bulk arrests are intimidating for everyone. Bought my house because my parents had actually helped in its construction in 1957 and was built by my best friends aunt. I am not actually good at taking my own advice. | ||

Pammy |

Don't go by multiple(s) of your base salary is. You need to figure out what you can easily afford and continue to "pay yourself". Savings is incredibly important. YOu should beable to sustain yourself for at least 6 months incase you are injured, fired or some other catastrophe happens. That's just my opinion though...but because of my advanced age...you should take it as gospel!  | ||

Dynasport |

I am not one to give financial advice, but I will tell you not to overspend. I see that happen all the time. I almost had a heart attack buying the house I am in and it is in the neighborhood of 1.25-1.5X my salary. I wouldn't have made it through closing buying a house 2.5 or especially 3 or 4 times my salary. We just hired a guy in our office who makes a good bit less than I do. He is looking for a house now and the cheapest house he is looking at is twice as expensive as my house. I keep thinking, isn't this how we got into this mess? But I have two college age kids who are still somewhat dependent on my for their at least some money. Anyway, don't get caught up in the hype of buying something you don't need and can't afford. Good luck. Dan | ||

J2blue |

If you are married, or otherwise involved with a significant other, you may not have the freedom to choose a very conservative approach to home ownership. But, if you are single, find the cheapest rat hole you can tolerate and save, save, save as much as you can before getting the mortgage. Even if you do this for six months before signing on the dotted line you will be happier. Buck society. Yes, 20% down as a minimum is great advice. Anything less and you are playing the great casino of real estate valuations and counting on being able to sell the property for much more than you purchased it for just to break even. I got lucky last year and sold my house for what I wanted and needed about a month before the meltdown. In reality I broke even for all my effort and am now happily poor but not in debt to anyone. The bank isn't the only one who owns you when you have a mortgage and possibly other debts. Your employer owns you. Psychologically it all adds up. My real estate gamble didn't get me "ahead" it just got me out of all debt, including my pickup truck. Had I not sold and simply worked another 25 years to payoff the mortgage and retire from a mediocre job I would then have to turn around and sell the house to pay for all my old man medical bills in my golden years. Bleck! This isn't advice, only my personal plan. If and when I can save enough to buy a piece of undeveloped land for cash I will. Then, when I can save enough money to build a very modest domicile I will. Again, buck society, I will not build a McMansion. I will build a garage with modest living facilities...as long as it is just me living alone. Should a gal manage to tie me down in the future I certainly hope I pick one who is old school and willing to live as modestly as I can. Philosophically this seems to be the only way to true freedom in life that I can imagine. The "norm" of home ownership today just seems to make us all into working serfs with a superficial veneer of wealth and freedom. | ||

Redefine420 |

Court that tip is Golden! Thank you! | ||

Loki |

I walked in and told the banker what my max payment was going to be. Came in comfortably under that. Now I can put extra towards my principal every month. | ||

Ourdee |

This time of year is great for yard sales. Best way to talk to the prospective neighbors. Dress like an old man and they will never remember having met you before you move in. I actually went to the yard sale at my house while waiting on closing. | ||

Blake |

I've purchased two homes. Neither mortgage exceeded double my fairly meager annual salary. Do yourself a favor and avoid strapping yourself with a stifling mortgage. If you cannot continue to put 10% towards retirement, then you are spending too much. | ||

Stingaroo |

Bhillberg, excellent thread, alot of knowledge being shared! The wife and I were just talking more seriously about a house. We are currently saving up most the money I am making here, then when I get home the house search is in full swing. Court, Kate is doing the same thing, when she sees a house that kinda hits our interest, she walks the countryside, and drives around looking for the closest firehouse, traintracks, post office, etc. She is just checking out what is on the market, and cost of living in different areas. Bill and Psquared, we are also thinking of going the VA route as well. We are goign to stay in the apt till I get settled back into civilian life, and we see if I have some longevity with my civilian job. When we figure out the finances, we just go off my civilian pay at BAE at 40 hours a week, and do not include overtime, Guard pay, or any side money. |