| Author | Message | ||

Needs_o2 |

Do the lenders set their own guidelines for qualifying or are they forced to follow preset ones? | ||

Bluzm2 |

Dave, I have tremendous respect for you but you are dead wrong on this one. I have a number of friends in the housing business (or used to be) in areas from land development to financing to building to remodeling. All of them predicted the housing bubble crash years before it happened. The only ones that were blind to it were the idiots in Washington that FORCED lenders to make loans to borrowers they knew were suspect. They are the ones that CAUSED the problem. Washington then steps in and buys the paper back (Fannie, Freddy). When the money faucet is open and there is no risk for the lenders the laws of supply and demand kick in. Builders build because there are buyers. Because there are buyers and supply is tight, prices go up (remember the old supply and demand thing). Higher prices are not a problem because the Feds (Pelosi, Reid, Frank) pass laws allowing goofy mortgages so that folks wouldn't normally qualify (and are lacking good judgment) can now qualify for mortgages that put them way over their heads. There is NO way a 28 year old newly married couple can realistically qualify for a $500,000 mortgage. I personally know of many that did. Many no longer have a house. The housing bubble was the major tipping point that caused a cascade effect for the economy. Why didn't our semi socialist neighbor to the north have the problem? They don't have a Fannie or a Freddy to by bad paper! They banks and lenders will only lend to truly qualified buyers. This is the way it was here before the nanny state stepped and tried to "fix things". The government CANNOT ever do anything right when it comes to market dynamics. They only mess things up. There is much more detail and intricacies to the above but this is the Readers Digest version. | ||

Bluzm2 |

Rein, Ya beat me to the punch... | ||

Reindog |

Obama Chavez and his Wonderful Congress continue to demonize the so-called "rich". Goebbels taught us the more you repeat a lie, the more it becomes the truth. Case in point. The "rich" is now anyone who makes more than $250K. I live in Kalifornia which is a high cost state (why is a different topic). I am not considered a class enemy yet (though I wish I qualified) and I can assure you that people or businesses earning $250K are not rich. Yet, they are the ENEMY of the PEOPLE. Watch television and all one hears is the droning of the Democrats demonizing the "rich". All these bastards are going to accomplish is to convince small businesses to curtail growth and lay off their employees so they can pay their higher taxes as a result that they are "rich". The enslaved who vote Democrat feel good about their class hatred yet they wonder why their quality of life continues to degrade. Idiots. Perhaps the Democrats could index their hatred to inflation. In time, everyone will be "rich". The only, ONLY path to wealth for those willing to work and renewed greatness is through Conservatism. Period. | ||

Sifo |

Do the lenders set their own guidelines for qualifying or are they forced to follow preset ones? There are conforming and non-conforming loans. Most that wind up being conforming loans, which means that it conforms to Freddie/Fannie qualifications. Usually the non-conforming loans are very similar, but with a minor change in qualifications to target a specific issue with qualifying under a conforming loan. Conforming loans are always preferred by the lender because the government funds their purchase from the lender freeing up funds for the next loan. Non-conforming loans are often retained on the books of the lender, but that takes funds away from future loans. Other non-conforming loans get sold to private investment firms, but their funds are not unlimited. We need to get back to making people save up 15-20 percent for a down payment. That helps people thing twice about walking away from a loan. It was a very bad idea to start financing 105% of the loan so that you not only don't need a down payment, but you can also borrow the closing costs. | ||

Sifo |

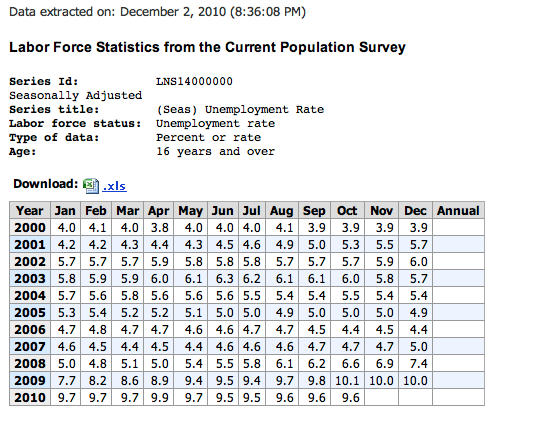

You can add a 9.8 for November 2010. Sure glad BO had a plan that would keep unemployment under 8%. I heard this morning that this the longest run of unemployment over 9.5% in history.  | ||

Court |

The lending thing gets better . . . at one time there was pressure to give loans to less than qualified folks. Now . . .with interest rates at historical lows . . . I have recently seen the other end of the spectrum where loans are denied to well qualified folks simply as a result of banks not wanting to have loans out at such low rates. How about a person who make a $1,000,000+ salary, owns their $1.3M home outright, has no credit card debt, a nice savings and retirement account and an 822 credit score . . . turned down for a $150,000 home improvement. These are indeed . . odd times. Things are not as they appear to be and it almost looks like the purpose of some in power is to cast us into a sort of class warfare. I know a few wealthy folks, Stanley Druckenmiller (you can google him) who has simply said "enough is enough" . . cashed in their chips and left the table. Public statement something like . .

Money . . like water . . . always finds a way. | ||

Sayitaintso |

We need to get back to making people save up 15-20 percent for a down payment. That helps people thing twice about walking away from a loan. It was a very bad idea to start financing 105% of the loan so that you not only don't need a down payment, but you can also borrow the closing costs. I can hear it now..... [sarcasm font] Oh for shame, you'd deny the most vulnerable (and those that can least afford it) in our society the RIGHT to the American dream.[end sarcasm font] As other have alluded to but not said outright, what folks qualify for and what they can afford are NOT the same thing. Anyone the borrows everything they "qualify" for will soon be bankrupt. And we shouldn't pin the whole debacle on the dems, they may have pushed for it but the repubs weren't fighting against it. They are both guilty, suggesting otherwise is disingenuous. If I remember correctly the financing changes that started the whole mess began under "Bush the Elder" and were pushed to insane levels under Clinton, and then the dems resisted changes to back off from the insanity (even though the repubs controlled congress). | ||

Sifo |

The insanity started with the Community Reinvestment Act under Carter. The insanity was reinforced under Clinton. The problem is that if you stand up against the insanity, you get labeled a racist bigot. Even at this point nothing has been done to correct this problem. When the economy finally recovers we will be back to stacking the same building blocks again. It will seem fine for a long time again until the bubble bursts again. We as a country have become very stupid. | ||

Court |

We reached an unusual point when we determined it was "discrimination" to not loan money to a person who could not likely afford to pay it back. Imagine . . . if we all followed the example of our leaders. . . . We . . at least at one time . . deserved better. | ||

Davegess |

The Community Reinvest act did not require you to make loans to non qualified people. It did require you to make loans to qualified people who wanted to live in areas you didn't want to make loans in otherwise known as Redlining. These loans did not blow up the entire system. Folks like Countrywide actively solicited and originated loans to wildly unqualified folks, many who were not required to document, income, employment ore any other info that one would think you would want before a loan was made. BUT since you could sell these as mortgage bonds so fast that you had no risk all you wanted was that origination fee, which was added to the loan. In the two years before this crash there was so much money trying buy these bonds (which were rated "Investment Grade AAA" by the idiots at the rating agencies pretty much irregardless of the actual quality of the loans) that the lenders could not find enough folks to sign the paperwork. The result was the "shadow bonds"; I think these are the CDOs although all this terminology is very screwed up, these didn't actually have any mortgages attached to them they simply mirrored the performance of the actual bonds. This whole market, not really a secondary market more like tripledary or quardradary market as they were so removed from the actual mortgage, is bets on how other peoples bets are going to do. There were mortgage bonds packaged and sold as AAA were the home buyer NEVER made a payment. The loan should have been in default when it was packaged and resold. Some of these bonds contained nothing buy these types of loans. The raters sort of caught some of these and downgraded them from AAA but never to junk. The packagers would then repackage them and get them rerated usually as AAA. The handful of people who saw this and put some money into betting against these mad very large fortunes. I big part of the problem was the rating agencies passing these off as AAA; without that the things would not have sold. If all we had done was what the law intended in the first place NONE of this would have happened. All the "creative" repackaging led to the abuses that built the house of cards. The bond market is very lightly regulated. the result is huge profits for the Wall Street firms and huge risks for the rest of us. Regulate the bond market in a fashion similar to stock market along with real, live pricing information and a lot of this would be impossible. It is still the fault of Congress, the White House and Wall Street just not of the Community Reinvestment Act. | ||

Blake |

For many years the same concerned association of top economic advisors had not only warned of the systemic consequences of financial turmoil at a housing government-sponsored enterprise (GSE), aka Famnie Mae & Freddie Mac, but also put forward thoughtful plans to reduce the risk that either Fannie Mae or Freddie Mac would encounter such difficulties. The economic advisors repeatedly called for GSE reform dating back to as early as 2001 and culminating with 17 such admonishments to Congress in 2008 before Congress finally acted, too late. Who were these advisors and why were their please ignored by our gov't? See if you can guess from some of their communications below. Unfortunately, the warnings went unheeded, as the economic advisors’ repeated attempts to spur reform of the supervision of the GSE's were thwarted by the legislative maneuvering of those who emphatically denied the problem. 2001 April: advised congress that the size of Fannie Mae and Freddie Mac was “a potential problem,” because “financial trouble of a large GSE could cause strong repercussions in financial markets, affecting Federally insured entities and economic activity.” 2002 May: advised congress that the disclosure and corporate governance principles contained in the economic plan for corporate responsibility should also apply to Fannie Mae and Freddie Mac. 2003 February: explained that “although investors perceive an implicit Federal guarantee of [GSE] obligations,” “the government has provided no explicit legal backing for them.” As a consequence, unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market. September: recommended that Congress enact “legislation to create a new Federal agency to regulate and supervise the financial activities of our housing-related government sponsored enterprises” and set prudent and appropriate minimum capital adequacy requirements. November: advised that any “legislation to reform GSE regulation should empower the new regulator with sufficient strength and credibility to reduce systemic risk.” To reduce the potential for systemic instability, the regulator should have “broad authority to set both risk-based and minimum capital standards” and “receivership powers necessary to wind down the affairs of a troubled GSE.” 2004 February: cautioned Congress to “not take [the financial market's] strength for granted.” Again, the call from the economic advisors was to reduce this risk by “ensuring that the housing GSEs are overseen by an effective regulator. February: advised "the safety and soundness regulators of the housing GSEs lack sufficient power and stature to meet their responsibilities, and therefore…should be replaced with a new strengthened regulator." June: admonished further that "We do not have a world-class system of supervision of the housing government sponsored enterprises (GSEs), even though the importance of the housing financial system that the GSEs serve demands the best in supervision to ensure the long-term vitality of that system. Therefore, (we have) called for a new, first class, regulatory supervisor for the three housing GSEs: Fannie Mae, Freddie Mac, and the Federal Home Loan Banking System.” 2005 April: further implored that "Events that have transpired since I testified before this Committee in 2003 reinforce concerns over the systemic risks posed by the GSEs and further highlight the need for real GSE reform to ensure that our housing finance system remains a strong and vibrant source of funding for expanding homeownership opportunities in America… Half-measures will only exacerbate the risks to our financial system. then twice again in 2007... August: "first things first when it comes to those two institutions (Fannie Mae & Freddie Mac). Congress needs to get them reformed, get them streamlined, get them focused... December: "These institutions provide liquidity in the mortgage market that benefits millions of homeowners, and it is vital they operate safely and operate soundly. So I’ve called on Congress to pass legislation that strengthens independent regulation of the GSEs – and ensures they focus on their important housing mission. The GSE reform bill passed by the House earlier this year is a good start. But the Senate has not acted. And the United States Senate needs to pass this legislation soon. and continuing into 2008 as the situation became dire, a few examples of the many... February: "A new regulatory structure for the housing GSEs is essential if these entities are to continue to perform their public mission successfully. March: further urged congress to "move forward with reforms on Fannie Mae and Freddie Mac. They need to continue to modernize the FHA, as well as allow State housing agencies to issue tax-free bonds to homeowners to refinance their mortgages. April: further urged Congress to pass the much needed legislation and "modernize Fannie Mae and Freddie Mac. [There are] constructive things Congress can do that will encourage the housing market to correct quickly by … helping people stay in their homes. May: "Americans are concerned about making their mortgage payments and keeping their homes. Yet Congress has failed to pass legislation I have repeatedly requested to modernize the Federal Housing Administration that will help more families stay in their homes, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance sub-prime loans. "the government ought to be helping creditworthy people stay in their homes. And one way we can do that – and Congress is making progress on this – is the reform of Fannie Mae and Freddie Mac. That reform will come with a strong, independent regulator. "Congress needs to pass legislation to modernize the Federal Housing Administration, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance subprime loans. June: we need to pass legislation to reform Fannie Mae and Freddie Mac. July: Congress finally acceded to the above pleas, but it was too late. | ||

Sayitaintso |

Dave, I may be wrong here but weren't many of those bond ratings based on implied backing and Fannie and/or Freddie for the mortgages underlying the bonds? ..... and wasn't the implication of Fannie/Freddie backing was based on (due to) the Community Reinvestment Act? The whole thing is was, and still is, very convoluted | ||

Blake |

Who were the seemingly precient economic advisors quoted above? The Bush administration. Why would congress refuse to act on the administration's mandates? Follow the money. From FM&FM, to a horde of lobbyists, to congressmen, to ACORN, to the evil prosperity choking root of the entire mess, the Progressive political movement. The entire catastrophe at every stage demonstrates why an over-reaching, social-meddling federal gov't is by bar the most significant threat to our freedom and our prosperity. I like you too Dave, but Tom's analysis is accurate. The congressional obstructors and deniers in opposition to improved regulation of FM&FM stated emphatically that no problem existed... Some were found to have received sweetheart deals from interested mortgagers. Another was engaging in a homosexual relationship with a manager at Freddie Mac. One was head of the applicable senate committee; another was head of the applicable committee in the house. The executives at FM&FM meanwhile received massive bonuses, millions by cooking the books. They knew what was coming; they jumped ship before the impending disaster hit. They weren't stupid, just dishonest. If Jamie Gorlick isn't an enemy agent orchestrating the fall of America she sure plays the role convincingly. Maybe she's an idiot being played. Well, she sure got paid. America must beware of catastrophe involving any gov't related concern where that woman turns up. First 9/11, then the crash of FM&FM and global financial crisis. (Message edited by Blake on December 03, 2010) | ||

Sifo |

The Community Reinvest act did not require you to make loans to non qualified people. It did require you to make loans to qualified people who wanted to live in areas you didn't want to make loans in otherwise known as Redlining. Here's the problem... You take two buyers, one who makes 200K per year and one who makes 30K per year. Both can qualify for a loan that takes 2/3 of their income in loan payments. Only one of them is likely to not default on the loan though. Both will get government backed conforming mortgages however. This is what the Community Reinvest Act does in the real world. These loans did not blow up the entire system. Folks like Countrywide actively solicited and originated loans to wildly unqualified folks, many who were not required to document, income, employment ore any other info that one would think you would want before a loan was made. Freddie and Fannie also offered no-doc loans. They engaged in that practice long before Countrywide started doing it. Again it's the federally backed conforming loans. There were mortgage bonds packaged and sold as AAA were the home buyer NEVER made a payment. You are describing about 95% of the loans that are written. About 90% are, again... federally backed conforming loans purchased by Freddie and Fannie. The repackaging of loans only became a problem when huge numbers of loans started to default. Each loan in default has it's specific reasons, but most deal with making a loan to someone who was likely to default on the loan. Once the housing bubble started to crash the whole house of cards came crashing down. You are dealing in many half truths. I'm sure you are not doing that purposely. These are the half truths that have been fed to the public who generally doesn't know any better. Anyone who has seen how the system works knows better though. Bottom line is that you can repackage loans all day long with no problems as long as the debtors can repay. The federal regulations made it possible for high risk applicants to get financing under the guise of non-discrimination. Now those responsible for these regulations are trying their best to explain how they have no responsibility. | ||

Sifo |

Dave, I may be wrong here but weren't many of those bond ratings based on implied backing and Fannie and/or Freddie for the mortgages underlying the bonds? ..... and wasn't the implication of Fannie/Freddie backing was based on (due to) the Community Reinvestment Act? Absolutely correct. Again, federally backed conforming loans. | ||

Reindog |

These people are criminals. Off topic: why does Wesley Snipes go to prison but Rangel doesn't? | ||

Sayitaintso |

There is plenty of blame to spread around, inflated appraisals, Discovery Channel shows like "Flip that House", and so on. It wasn't just the big bad regulators. Lenders were not required to lower their lending standards, but if they didn't they missed out on the gravy train, and no one wanted to sit on the sideline and watch the other guy get fat. Realtors getting folks pre-approved for loans than then not showing any houses that weren't bumping right up against that pre-approval limit.} | ||

Blake |

>>> The Community Reinvest act did not require you to make loans to non qualified people. It did require you to make loans to qualified people who wanted to live in areas you didn't want to make loans in otherwise known as Redlining. Dave, with the implied federal backing of FM&FM, and with mandates from congress declaring what constitutes a "qualifying" mortgagee, and with the executives at FM&FM cooking the books while maintaining only a few percent of capital to back their loan guarantees, the system was guaranteed to crash at the slightest economic hiccough. The regulation desired by those who were concerned included minimum limits on capital backing that FM&FM would have had to maintain, something well above the few meager percent existing at the end of Mr. Reins' stint as CEO of Fannie Mae for instance. The more I learn, the more unbelievably outrageous it seems. The ENRON crooks met justice. None of the crooks at FM&FM have. They were all protected by powerful politicians. They walked away with millions while the global economy crashed, thanks in large part to their incredibly irresponsible management. I don't have an issue with TARP, for as you say, those loans are being repaid. I like the gist of Bill's idea to put an end to private enrichment protected by socialized backing. GM deserved to fail and should have been allowed to do so. The free market must be allowed to run free; survival of the fittest is what guarantees long term vigor, health, and prosperity for the largest portion of the population. Once we start interfering and propping up the weak, lazy, irresponsible, and diseased, we only guarantee ever more weak, lazy, irresponsible, and diseased. It's as true in society as it is in nature. It is the one core truth that so-called liberals and progressives refuse to acknowledge. Don't you agree? Do we want an animal farm or freedom? With all it's inherent risks, pitfalls, and challenges, I choose on the side of freedom every time. Anything the feder gov't does to impinge on freedom, forcing some to pay to prop-up others, is abhorrent to me. If we can prevent the government from wasting the labors of the people under the pretext of caring for them, we must be happy. | ||

Reindog |

To quote one who rides amongst us: "When the Government subsidizes something, all you get is more of that something." | ||

Mr_grumpy |

I thank you one & all for your illumination on all this, it's been nice to be able to get my head around it in sentences I can finally understand, rather than expert's gobbledygook. I get what you're saying Blake, but in that case who's to stop the scammers doing it all over again? The Bankers & Traders are all fixed on one goal, profit, & have proved time & again that they have no ethics whatsoever. I fully agree that forcing some to prop up others is unfair, but if the regulation which you so abhor had been more rigourous in the first place, the propping up wouldn't now be necessary, to my way of thinking. Oh & I'm not a commie or a socialist or a conservative or a liberal. I'll vote for whomever I think will do the best job regardless of political stamp. (Mind you it's getting tougher & tougher to find anybody that fits the bill these days) | ||

Reindog |

I agree with the Grumps (except that I am a Conservative). The issue here is not one of regulation, but of social engineering by this Wonderful Government and the resulting mismanagement and criminal activity of the players. You can always expect the profit motive to be chased by the ethical and unethical alike. That is simply human nature. People who are not yet Conservative have a tendency to become apoplectic and accuse us of being against regulation. That is far from the truth. Wrongdoers need jail time. Wrongdoers like Frank, Waters, Raines, Dodd, Jefferson, and Rangel to name a few. | ||

Blake |

Sir Grump, >>> I fully agree that forcing some to prop up others is unfair, but if the regulation which you so abhor had been more rigourous in the first place, the propping up wouldn't now be necessary, to my way of thinking. Those are two different issues. They are entwined in the housing crash. The federal gov't pushed for loan guarantees to spur banks to grant mortgages to those who would otherwise not receive them. That's gov't meddling in "social justice" kin to taking from some to prop up others. Then there is the lack of effective regulation of GOVERNMENT sponsored entities (GSE's), specifically Fannie Mae, Freddie Mac, and also the Federal Housing Authority (FHA). If you watch the above YouTube videos and read the text quoted in my post above, you'll see that the Bush administration and Republicans were virtually screaming for better, stronger regulation and oversight of the aforementioned doomed to collapse GSE's. Regulation of government entities? I say YEA!!! Oppressive regulation of private citizens? NAY! Would banks have offered mortgages to those they deemed high risk absent the backing provided by the gov't? No. A grossly over-reaching wildly irresponsible federal gov't & GSE's were the root cause of the entire problem. Big difference! | ||

Sayitaintso |

Would banks have offered mortgages to those they deemed high risk absent the backing provided by the gov't? No. A grossly over-reaching wildly irresponsible federal gov't & GSE's were the root cause of the entire problem. I dont disagree with what you are saying....to a point. I see the root problem as a lack of ethics; on the part of the politicians, business community, and consumers. Political because they created the foundation upon which the whole house of cards was built and willfully ignored signs of what was happening even when it was pointed out to them, and Business people because they were greedy and took advantage of ignorant, naive customers even when they knew the customers would ultimately be unable to repay the loans, and finally Customers because they lied, cheated, and whatever else it took to get something they wanted even though they couldn't afford it, and they didn't look out for their own interests. Ultimate responsibility lies with the people that bought the houses under terms they could not handle. In my opinion they deserve whatever happens to them and in many cases they are getting off too lightly. (I know I'm being outlandish but..... indentured servitude sounds just about right.) Being able to just "walk away" and have your credit ruined for a few years is BS. | ||

Buellbozo |

Just FYI, didn't know where else to post it... Just heard on NPR Business Update that this year's wall st. "investment" firms' year end bonus pool is estimated @ $80,000,000,000+. Shur 'nuff earned it, didn't they? Back to the Bunker.  | ||

Buellbozo |

The same Bush economic advisors also said the tax cuts should only last 10 years because the country couldn't afford it any longer than that. I'm probably too cynical, but I guess that was just a selling point at the time to get 'em through. I wuz gonna join Cynics Anonymous, but I didn't think it would work. | ||

Blake |

Unfortunately, with 100% mortgages (no down pmt), the mortgagees suffer little. A recent applicant to rent our house in Grand Prairie, TX was walking away from their own home, $967 total monthly mortgage plus escrow. They had fallen 5 months behind, had two children with another on the way, were in collection on a new pickup truck and trailer, she on unemployment, he only getting part time work as a truck driver. Our house rents for $1,070/mo. No down pmt on their mortgage. I just looked them in the eye and said, "I'm concerned how with a third child on the way you intend to manage $1070/mo if you were unable to meet your $967/mo obligation." "I think we'll be okay", she said.  I have to say though, they were honest. Another family had two children in private school, two new/newish cars, wife twice "laid off" from nurse assistant jobs, now taking classes, but then not went through bankrupcy in '02 and despite a $14K dn pmt, were walking away from their own home, monthly pmt $1400. Wife breathlessly explained that she just HAD to send her boys to private school and you couldn't take away her VW Beatle except over her dead body. The sense of entitlement that some people have is outrageous. | ||

Macbuell |

Commercial Paper is a short term investment and has low to moderate risk. So, the Government should have made money off those deals. I don't see the big deal since in the end they ended up with more money than they started. By the way, most issuers of Credit Cards invest in Commercial Paper with the float from Visa and MasterCard from whenever you use your credit card. I should know. I managed those portfolios for a number of years. Nothing like having to invest a billion dollars on a Monday morning. | ||

Sifo |

It wasn't just the big bad regulators. Lenders were not required to lower their lending standards, but if they didn't they missed out on the gravy train, and no one wanted to sit on the sideline and watch the other guy get fat. Lenders have a choice. Set their own loan qualifications, or use the conforming mortgage qualifications from Freddie/Fannie. Going their own route is very difficult unless you have very deep pockets. You run out of cash in a big hurry unless you can convince someone with deep pockets to purchase the paper on these nonconforming loans. That is very difficult to do BTW. You have to be one of the "big dogs" to even negotiate with the deep pocket folks on Wall street. The other option is to do a conforming loan that can be sold to Fannie or Freddie as soon as the loan is established and you have funds for the next loan readily available. So while lenders aren't actually "forced" to lower their lending standards, only a lender who can compete with the US Government can not lower their standards. The problem becomes a matter of do you set higher standards and hold on to the mortgage, taking on the risk if it defaults, and tying up your cash for the life of the loan, or do you lower your standards so that you can sell the mortgage immediately, getting your cash back so that you can do more business, and get out of the liability if the mortgage defaults. The game is rigged so that there is zero upside to not lowering your standards to the conforming mortgage. Who would have ever thought that the government would rig the game in such a way? Just wait until you get a taste of how health insurance companies wind up "competing" with the government under Obama-Care. Just sayin'. Business people because they were greedy and took advantage of ignorant, naive customers even when they knew the customers would ultimately be unable to repay the loans, and finally I'm not going to say that there were zero unscrupulous lenders, but for the most part there was little need to be unscrupulous. Government regulations force the lender to give the customer as much loan as the customer wants, as long as they "qualify" under the loan specs. You don't have the option of saying to the customer "I really think you should consider a smaller loan amount". That simply gets you prosecuted by the government. It's actually fairly difficult to get less scrupulous than following the letter of the law in the mortgage industry. Seeing it from the inside, those who do well in the mortgage industry actually do very well by their customers. They get a lot of repeat business, personal referrals, and eventually the customers kids grow up and gets loans from you. Meanwhile the unscrupulous will crash and burn repeatedly. | ||

Sifo |

Unfortunately, with 100% mortgages (no down pmt), the mortgagees suffer little. Even less risk with 105% financing. To be fair though, I've only seen 103% financing (no money down + closing costs) backed by the government. You can get grant programs to make up the balance if you need to though. Insanity! |